If you're looking for an alternative to You Need a Budget (YNAB), you're in the right place. I’ve been closely following YNAB as it’s evolved over the last few years. I remember YNAB4 when it was a software application you purchased. I remember when it transitions to a monthly service. I remember how upset people were but I felt from a business perspective, it made them better suited to invest in the business to make it even better.

There are several reasons why you might be looking to replace YNAB. The best alternative for you will depend on why you're replacing it. Whether it was the recent price increase, outgrew the product, or you feel like you could do it on your own?

With plenty of options we breakdown the top 5 YNAB alternatives below.

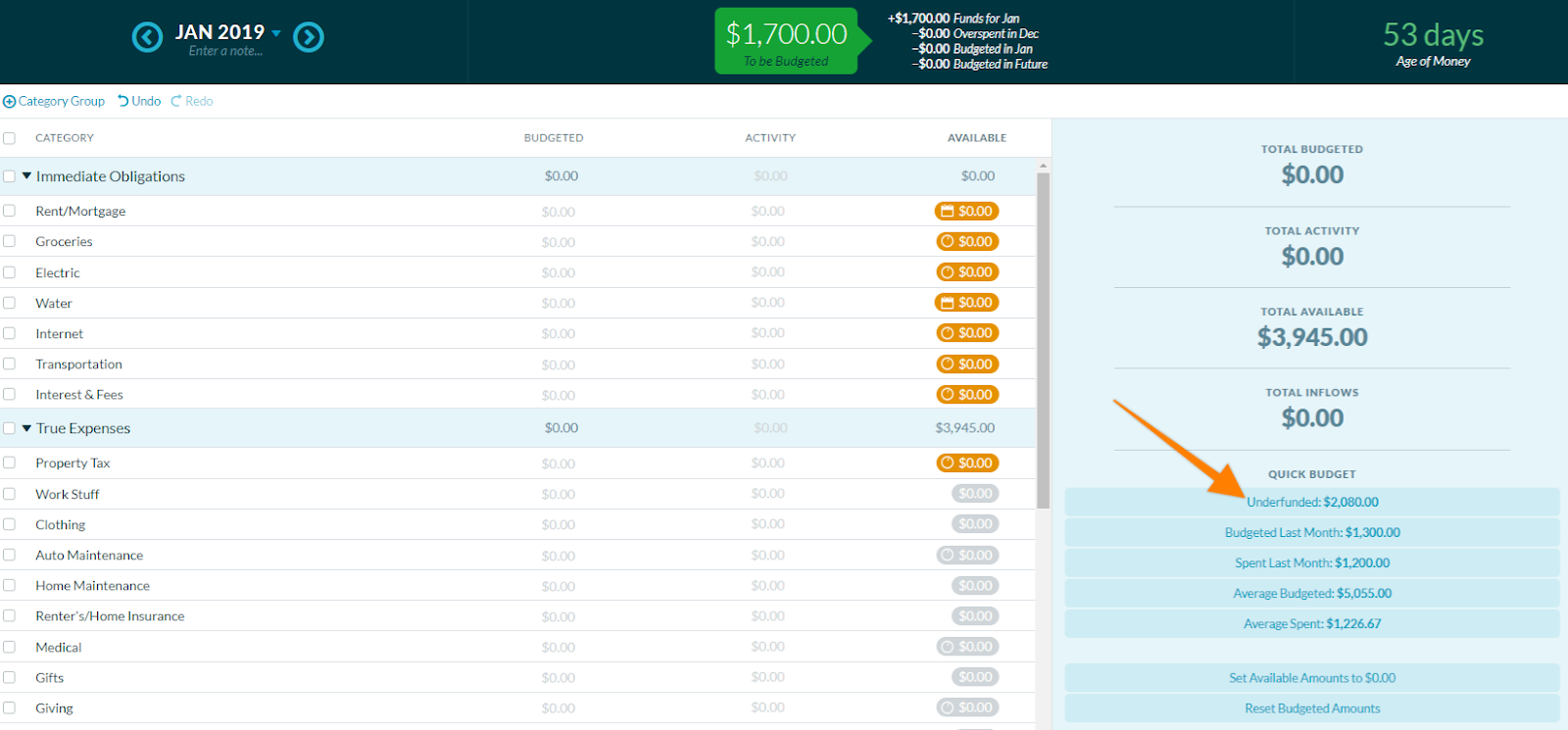

YNAB 5 is a completely hosted solution, with a future desktop application to interact with the service. For some, the convenience may be worth the risk. I left Mint because I didn't want to share my data, no matter how buzz-full their security policy sounded. Nov 08, 2017 For this review, YNAB means the web based, subscription version and YNAB 4 refers to the old, downloadable version. I used YNAB and YNAB 4 side-by-side for about a month and a half in order to answer these questions: Is YNAB worth using for new users? Should YNAB 4 users upgrade to YNAB?

Why Do You Want to Switch?

The YNAB Price Increase – YNAB used to be $50 a year, billed annually. It will now be $6.99 a month, still billed annually so $83.88. It's a sizable percentage increase but not a significant dollar increase, just under $3 a month.

I think it's worth $3 a month for YNAB but long-time users have had to navigate two pricing changes the last few years – first, when the software went from a flat fee to a monthly fee; now, to a slightly higher monthly fee.

To put it into perspective, EveryDollar is a budgeting app that has a free component but costs $129.99 a year for their Ramsey Plus (they rebranded it and added features to what was previously EveryDollar Plus).

It follows Dave Ramsey's Total Money Makeover approach, has a similar “give every dollar a name” philosophy, and is on a freemium model. That means the app is free but if you want to connect financial accounts, download data automatically, that'll run you $129 a year. It's still cheaper than one of their most similar alternatives (which we don't list below because it's more expensive).

You've Graduated – Congratulations! YNAB has put many people on the path to sound budgeting with its “Every Dollar Needs a Job” mentality. If you're ready to graduate to a free tool without as much guidance, then there are several options below.

If you need less guidance and you want more support in the area of investing and retirement planning, my best recommendation is Personal Capital. It offers a personal finance dashboard that lets you plan for your investments and retirement better than any of the alternatives.

If you need less guidance and just want to track your budget, my best recommendation is Mint. Track your budget automatically, completely free, but you don't get the same philosophy and guidance as YNAB. We compare YNAB vs. Mint in a head to head comparison that you can use to decide if mint is the one for you.

What We Looked For

You chose You Need a Budget for a specific reason and it's not just to “track your budget.” There are a ton of budgeting apps out there and most of them are free.

You chose YNAB because of the philosophy and how the tools married with those philosophies. You wanted more than a simple tracker tool.

We also didn't include alternatives like EveryDollar (until the end) because they were more expensive. We recognize YNAB is pretty solid on features so you're probably looking for a cheaper replacement rather than a more expensive one. (if we're wrong, let us know!)

1. Tiller

What is Tiller?Tiller is an automation tool that integrates with Google Sheets so you can build your own budgeting spreadsheet while pulling in data automatically from your accounts.

Why is Tiller a good YNAB alternative? First and foremost, they have a way to import your YNAB budget into a Google Sheet. So if you wanted to make the transition, it's super easy.

Second, and this is more about spreadsheets than about Tiller specifically, but you get complete control and customization with Tiller powering your spreadsheet. You tailor the spreadsheet to exactly what you want and they pull in the data so you avoid the manual data entry. I use a spreadsheet for this very reason.

Tiller is just $79/year after a 30 day trial, which makes it slightly cheaper than YNAB. If you start using it and are able to save more money in your budget, those savings could easily pay for Tiller. Read our Tiller review for a deep look at what makes this tool so great.

2. Personal Capital

What is Personal Capital? Personal Capital is a personal finance dashboard that will aggregate all of your accounts in one place. They have a premium financial advisory service as well as wealth management, but those are optional (I don't use them). There are also powerful planning tools, like planning future income in retirement based on your expenses, that really make it a 30,000 foot view other tools don't even try to do.

Why is it a good YNAB alternative? It's not a good budgeting tool replacement for YNAB but if you want to graduate from just budgeting to higher-level financial management, Personal Capital can be a helpful tool. I don't mean “higher level” as in “better” or “superior,” I mean 30,000-foot view vs. 10,000-foot view.

Budgeting is crucial but it has a short-term view. You may budget your paycheck, which may be weekly, bi-weekly, or monthly. You may budget annually too – but you won't be budgeting from now until your retirement. That's why a tool like Personal Capital can be valuable – giving you visibility on the long term view.

Personal Capital is free.

3. Mint

What Is Ynab Classic Download

What is Mint? Mint is one of the oldest budget tracking packages out there and they are owned my Mint, who were the former owners of Quicken. Mint has everything you need in a budgeting app and is completely free. Many of the budgeting tools may sound familiar to YNAB but they will take getting used to it. You have bill pay functionality as well plus additional features like credit monitoring and some investing tracking (but no recommendations or advice).

Why is it a good YNAB alternative? If you need a budget but don't want to pay for You Need a Budget, this one gets you all the budgeting functionality at absolutely no cost.

Mint.com is free.

4. CountAbout

CountAbout was designed specifically to be an alternative to Quicken, which is one of the oldest and most popular budgeting packages out there. CountAbout was founded in 2012 and offers a very rich feature-set at a very modest price. It costs just $9.99 for the Basic and $39.99 for Premium (which includes automatic transaction download).

Here are some of the other key features, making it a solid budgeting tool without the monthly fee:

- Imports data from Quicken and Mint

- 12,500+ financial institutions

- Multi-factor login protection

- Android and iOS apps

- Category customization (add, delete, rename)

- Tags (add, delete, rename)

- Reporting for Account balances

- Reporting for Category activity

- Reporting for Tag activity

- Report exporting

Ynab Desktop App

- Individual Account QIF importing

- Budgeting

- Running register balances

- Account reconciliation

- Graphs for Income & Spending

- Recurring transactions

- Investment balances by Institution

- Memorized transactions

- Split transactions

- Description renaming

Ynab Free Version

5. EveryDollar

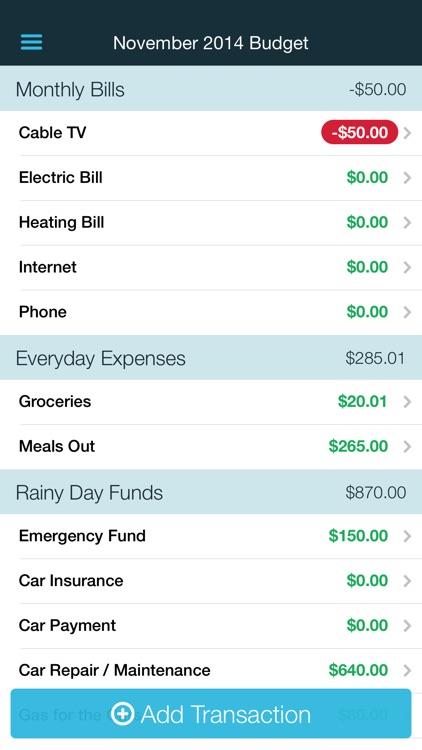

EveryDollar is a very basic budgeting tool created by the team behind Dave Ramsey, using his principles for managing money. We reviewed EveryDollar and found that it's claim of being able to set up a budget in 10 minutes to be accurate – it's super simple, very easy to navigate, and follows the overall structure of Dave Ramsey's Baby Steps.

It is a freemium product with the free version letting you do everything the budgeting tool offers. There is an EveryDollar Plus (now part of Ramsey Plus) that's $129.99 per year which adds in automatic transaction downloads and a few other features. With the Free version, you have to manually enter all of your transactions.

Conclusion

If You Need a Budget has served you well, my recommendation is to find a few bucks each month to continue paying for it. No tool offers what it does at a cheaper price and there's a reason why it's one of the most popular personal finance tools out there – it works.

One of the nice things about many of the recommendations on this list is that they have trials or are completely free. Keep with YNAB, try one of the alternatives we listed, and if it wins – switch. If it doesn't, you won't have lost a step with your existing budget.

Ynab Classic Android

Ynab Classic App

Other Posts You May Enjoy